The Right Insurance Plans To Meet Your Needs

Medicare Supplement Insurance Plans

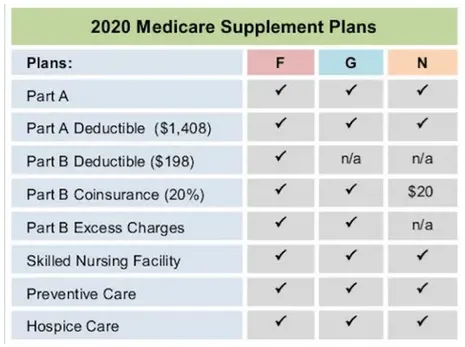

YMedicare is an essential health care coverage for most seniors, but sometimes it does not cover all health care costs. Medicare Supplement Insurance or Medigap is supplement with health insurance to cover medical expenses that Medicare does not cover. Unlike Medicare, Medicare supplement insurance is not a federal program but is instead offered by health insurance businesses, which are stringently regulated by the federal and state government.

Whether you wish to cover Part A, B, or D costs, DFW Health Solutions can find the most advantageous plan that is perfect for your particular budget and needs. There are a variety of supplement plans available to help cover your specific medical requirements. Our team enables you to find and understand the supplement plan that could work for you. First, you need to estimate how much you pay out of pocket on Medicare only. Medicare supplements are intended to help cover the costs partly or wholly and can save you money in the long run.

Our team at DFW Health Solutions will help find you the right supplement option that works best for you.

During your free consultation, you will meet with one of our staff members in person, and we will go through the various supplement options that will help cover your specific requirements. We will educate you and explain the supplement choices that we believe would best benefit you, so you have full knowledge of your options. Our team helps all of our Medicare customers find the most beneficial options.

Important Information About Medicare Supplement Insurance (Medigap)

You need to have Part A and Part B

You pay a private insurance company a monthly premium for your Medigap policy in addition to your monthly Part B premium that you pay to Medicare. Also, if you combine a Medigap policy and a Medicare Prescription Drug Plan administered by the same company, you may need to make two separate premium payments for your coverage. Contact the company to determine out how to pay your premium.

A Medigap policy covers one person. Spouses must purchase separate policies.

You can't have prescription drug coverage in both your Medigap policy and a Medicare drug plan. The same insurance company could offer Medigap policies and Medicare Prescription Drug Plans.

It's crucial to compare Medigap policies since the cost can fluctuate between insurance companies for the same coverage, and might go up as you get older. Some states limit Medigap premium prices.

About Eric Dalton

Eric Dalton is a longtime North Texas resident with deep roots in the community. Eric earned his degree from the University of Southern California in Economics. Eric has strong family values and has twin seniors in College. He understands the importance of having your health plan work for you when you need it the most. Eric is very proud of his high retention rate amongst his clients. The happiness of his clients is a direct result of listening to their needs and making sure they have the right coverage at the best rate. Eric’s philosophy is “whether you insure with me or not, make sure that you have health insurance, and do not expose you or your family financially.”

Get A Free Quote

We Specialize In The Following Types Of Insurance

Health Insurance (PPO only)

Guaranteed Acceptance Insurance (PPO only)

Dental Insurance (PPO only)

Market place Plans

Individual & Family Plans (Including Child Only)

Self-Employed & Small Business Owners

Realtors & ISD Employees

Our Satisfaction Guarantee

We’re here to help you to locate the best medical insurance coverage at the best price. We are available on weekends and evenings to run health quotes for our clients. With us, there are never any broker fees, so you know you will always get great service and low rates.

We work to make our clients happy and offer a 3 PART GUARANTEE with each plan sold.

PART 1

Our 100% Satisfaction Guarantee: If you are not 100% satisfied with the company you select, we will gladly place you with another company of your choice and if there is an application fee, we will cover the cost up to $25.00.

PART 2

Meet or Beat Rate Guarantee: After we find a plan that meets your needs and budget, if you find the same identical coverage for less, we will meet or beat the rate.

PART 3

No Obligation Guarantee: If for any reason you decide you would like to change insurance companies after we finish your application, just call us and we will be happy to find another plan for you. All of our plans are month-to-month with no long-term contracts.

Contact DFW Health Solutions today at 214-674-8812 to get started finding the perfect insurance plan for your needs.

Client Testimonials

Eric is an exceptional business professional, an expert in business acumen. Strong leadership skills combined with his laser focus and determination to see others succeed. He consistently demonstrates solid work ethic, and commitment to his business and clients. After getting to know him and learning more about his story it is easy to see where he gets his confidence and powerful personality. Self motivated professional lots of knowledge in his field. He leads by example & has lots of enthusiasm for life.

Mario J.

Customer Review

Eric Dalton has gotten insurance for our whole family. The coverage is great, on top of huge savings. Glad to have Eric and DFW Health Solutions taking care of our families insurance needs!

Craig F.

Customer Review

Location Served

Dallas/Fort Worth Metroplex

Give us a Call

Send us a Message

Our Mission

Our ultimate goal is to provide our customers’ quality health insurance that will work for our clients when it is needed most at the best and most affordable price possible.

Contact Information

DFW Health Solutions

1334 Romano Place Dallas, TX 75215

214-674-8812 | 855-864-5577

© Copyright 2024 DFW Health Solutions | All Rights Reserved